Why do Residents need more insurance if they have Medicare and/or Medicaid?

- 360care insurance plans make comprehensive care accessible and affordable and provide additional benefits that may not be covered by Medicare and Medicaid.

- Coverage is available at no additional out-of-pocket cost for qualifying Residents.

- There are no deductibles, no co-pays, and no waiting periods or prior authorizations for any services. All products, such as glasses, dentures and hearing aids, come with warranties.

How does it work?

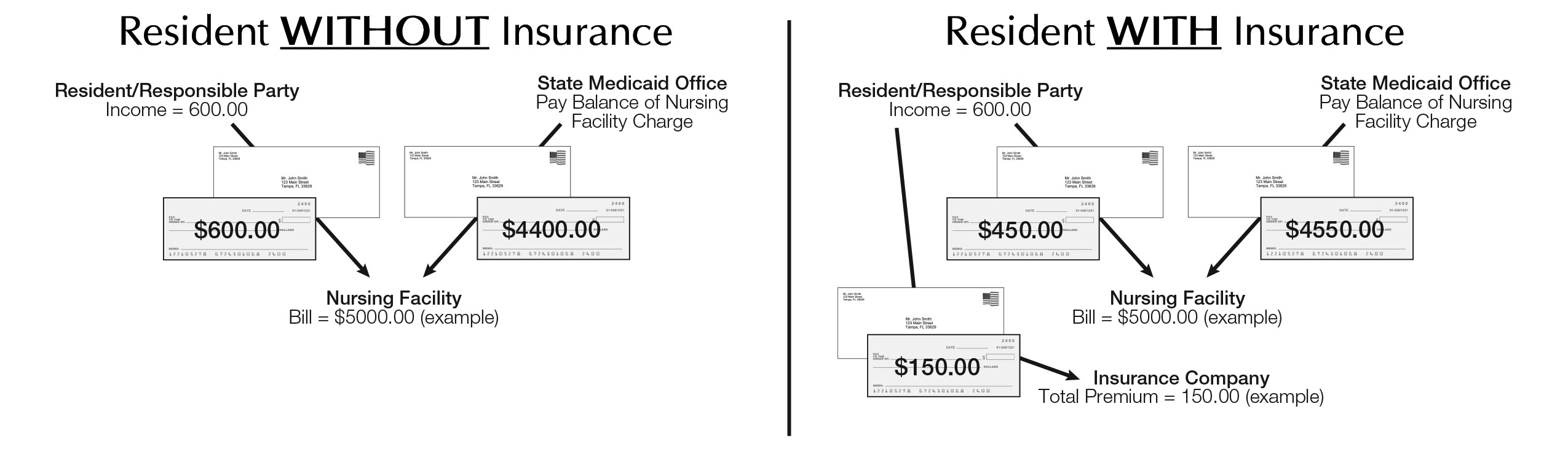

- Qualified Medicaid Residents who reside in nursing home facilities pay what income they receive to the facility each month. This amount is referred to as the patient pay liability.

- Federal law mandates that a Medicaid Resident may purchase health insurance policies with his/her income.

- 360care plans qualify as an allowable deduction, so most Residents can have their patient liability reduced by the amount of the insurance premiums.

What does this mean?

- Qualified Medicaid Residents may have all of these benefits covered by the insurance at no additional cost to the Resident or the nursing home facility.

*Check with 360care to see which insurance plans are available in your state.

*360care insurance plans are issued by Citizens Security Life Insurance Company, Louisville, KY.